The Orange County Property Appraiser’s Property Search tool is your gateway to reliable, up-to-date property information. Whether you’re a homeowner, potential buyer, real estate agent, or researcher, this easy-to-use tool allows you to access accurate property records, tax histories, and legal descriptions without needing to visit an office or pay a fee. Designed with simplicity and clarity in mind, the tool is optimized for desktop and mobile, ensuring smooth searches from any device. All property records are sourced from official public data and maintained regularly to reflect the most recent updates. From locating a property’s market value to understanding deed changes, this platform puts powerful search capabilities right at your fingertips.

Property Search Tool

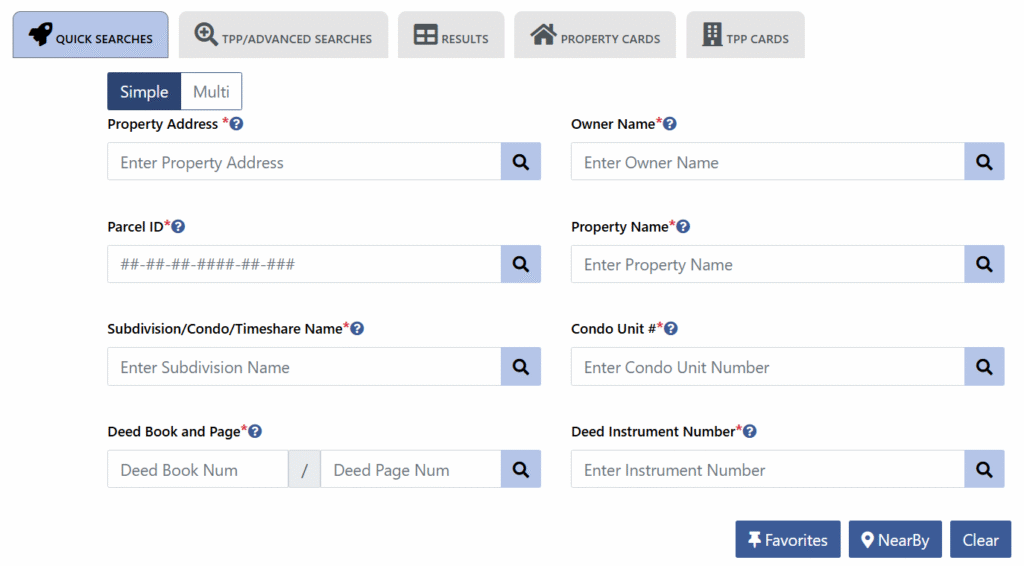

The Property Search Tool offered by the OCPAFL is more than just a look-up service. It acts as a comprehensive platform that bridges the gap between citizens and the county’s public property data. Built to serve a broad spectrum of users—from first-time buyers to seasoned real estate professionals—the tool allows anyone to search properties by address, parcel ID, or owner name. This intuitive system is designed with usability and accessibility at its core. With real-time data integration, users can find recent sales, ownership transfers, and even zoning details with just a few clicks. Each property listing also includes interactive maps, boundary outlines, and clickable tax roll data.

Why Use the Orange County Property Search Tool?

Using the Orange County Property Search Tool brings several practical advantages. First, the data comes directly from the Property Appraiser’s records, ensuring reliability and legal validity. This tool is designed for homeowners trying to assess equity, agents conducting competitive market analysis, and appraisers verifying valuation details. Additionally, the platform’s clean interface means that no technical skills are required—simply input the necessary details, and you’ll get instant results. Unlike third-party websites, which may offer outdated or incomplete data, this official tool provides accurate ownership records, tax payment history, and exemption statuses. Users can even view changes over time in market versus assessed value.

What Can You Find with the Property Search Tool?

Through the Orange County Property Appraiser’s search platform, you gain access to a wide range of valuable property details. This includes:

- Current and historical ownership records

- Assessed and market property values

- Legal descriptions, parcel size, and zoning info

- Tax history, including any delinquencies or exemptions

- Last sale price and deed type

- Interactive parcel map overlays

Each record page provides this information in a clear layout, and users can export the data as a PDF or print directly for their records. The database is updated routinely to ensure compliance with the latest assessment cycles, giving users the peace of mind that they are viewing current data.

Who Benefits from Using This Tool?

This Property Search Tool benefits a diverse group of users. Homeowners can track changes in their property value and confirm that exemptions are applied. Buyers and investors use the tool to compare prices and assess investment potential. Real estate agents rely on it to build comparable market analyses, while appraisers and legal professionals access records for formal reporting. Researchers and journalists find it helpful for analyzing development trends, and contractors often use parcel data for zoning checks. Overall, this tool democratizes access to public property data, ensuring transparency and informed decision-making for all stakeholders.

How to Search Orange County Property Records

Navigating Orange County property records is a simple, step-by-step process thanks to the Property Appraiser’s intuitive digital tools. Users can perform searches using one of three key methods: address, owner name, or parcel number. Each method is tailored to suit different use cases, whether you’re trying to verify ownership, research development potential, or track historical valuation trends. The platform offers clear instructions and a clean interface that guides users at every stage. Even if you’re unfamiliar with property databases, the tool ensures you can complete your search with confidence and accuracy.

Search by Address

Searching by address is the most commonly used method for homeowners and buyers. Simply type in the street address (including house number and street name) to pull up the property profile. The system auto-suggests results, so even partially complete inputs will offer suggestions. Once located, you’ll see the property’s legal description, parcel ID, assessed value, sales history, and any exemptions. This method is ideal for verifying your own records, checking out a new listing, or exploring surrounding properties in the same neighborhood.

Search by Owner Name

If you know the property owner’s full name, you can retrieve all properties registered under that name. This method is especially helpful for legal professionals, real estate agents managing multiple listings, or citizens researching family-owned assets. Enter the name as “Last, First” for best results, and refine using middle initials if needed. The results list will display all matches, and each entry will link to the detailed property record.

Search by Parcel Number

The most precise method for accessing property data is by using the Parcel ID or Alternate Key. This unique number eliminates confusion over similar addresses or owner names. It’s typically used by professionals, government workers, and researchers who require exact data for legal documents, tax filings, or land use planning. You can find a parcel number on your property tax bill or via prior search records. Entering it in the search field will directly pull up the relevant parcel, skipping broader search results.

What Information is Available in Property Records?

Orange County property records contain a wealth of valuable information that can be useful for homeowners, buyers, real estate agents, legal professionals, and researchers. These records include everything from basic property ownership to detailed financial histories, zoning details, and legal descriptions. The records are regularly updated and maintained by the Orange County Property Appraiser’s office, ensuring that the data you retrieve is accurate and reliable.

Property Ownership & Deed Records

One of the primary features of property records is the ownership and deed information. These records show who currently owns the property, when it was purchased, and how much was paid for it. The deed is a critical legal document that establishes ownership of real estate, and it often includes the buyer’s and seller’s names, the sale price, and the date of the transaction. Property records may also include historical ownership data, such as previous owners, giving you insight into the property’s history.

For legal professionals, appraisers, and real estate agents, ownership and deed records are vital for verifying current and past ownership claims. These details can also be used to confirm if a property is subject to certain legal restrictions or to check if there’s an unresolved dispute related to ownership.

Assessed & Market Value

Property records also provide information about the property’s assessed and market value. The assessed value is determined by the Orange County Property Appraiser and is used as a basis for property taxation. The market value, on the other hand, is an estimate of how much the property would sell for on the open market.

These values are crucial for homeowners trying to understand their tax liabilities, as well as for prospective buyers and investors who need to evaluate whether a property is priced fairly. The difference between assessed and market values can be substantial, as assessed values often reflect a more conservative estimate used for tax calculations, while market values fluctuate based on real estate trends.

Property Characteristics & Legal Descriptions

In addition to ownership and financial information, property records include the legal description and physical characteristics of the property. The legal description provides detailed information about the property’s boundaries and size, which can be critical for zoning, land use, and building purposes.

The property’s physical characteristics might include the lot size, number of buildings, square footage of each structure, and details on any improvements or additions made to the property. This data is often used by investors, contractors, and property developers who want to assess the viability of further development or understand the potential value of the land.

Property Tax History

Finally, property records also show tax payment history. This includes annual tax assessments, payments made, and any exemptions that may apply, such as the Homestead Exemption. Understanding a property’s tax history can provide valuable insights into its financial standing, revealing any overdue taxes, penalties, or other fiscal issues that may affect the property’s marketability.

For homeowners, this data helps ensure that taxes are up to date and that exemptions are properly applied. For potential buyers, reviewing the tax history can help gauge how much they can expect to pay in annual property taxes and if there are any discrepancies in tax records. Real estate professionals often use this data to perform tax calculations when appraising a property or preparing for a sale.

How to Access & Download Property Records & Deeds

Orange County’s property records and deeds are easily accessible through the Property Appraiser’s website. With just a few clicks, users can retrieve vital documents and data related to their property, whether they are searching for specific ownership details, tax information, or legal descriptions. The process is streamlined for both public access and professional use, ensuring that anyone—from a homeowner to a legal researcher—can get the information they need without hassle.

Requesting Official Property Records

Requesting official property records from the Orange County Property Appraiser’s office is straightforward. Follow these steps to obtain certified or detailed public documents:

Need Help?

If you encounter issues, contact the Property Appraiser’s office via phone, email, or by visiting one of their physical locations for assistance.

Visit the Official Website

Go to the Orange County Property Appraiser’s website using your preferred web browser.

Navigate to the Property Search Tool

Click on the “Search Records” or “Property Search” option from the homepage menu to open the tool.

Search for the Property

Enter the property details using one of the three search methods: Address, Owner Name, or Parcel Number. Once located, select the correct listing.

Review the Available Records

On the property details page, review the documents and records available. This typically includes ownership history, assessed values, tax roll data, legal descriptions, and prior deeds.

Request Certified Records (if needed)

For certified copies of deeds or official documents, follow the provided link or instructions to request them from the Clerk of Courts or Records Department. A small fee may apply depending on the type of document.

Download or Print

For most non-certified records, you can simply download PDFs or print the page. Use the “Download” or “Print” button on the record page.

Downloading Publicly Available Documents

For users looking to download property records or related documents, the process is straightforward. Once you have accessed the specific property record via the search tool, there is typically an option to download available documents directly from the webpage.

For most users, documents like tax records, assessment details, and property history reports can be downloaded as PDFs or accessed through a downloadable link. These are typically the most requested documents, as they offer transparency regarding the property’s current status.

The system allows you to download multiple files for properties in bulk if needed, which is particularly useful for real estate agents or investors looking to analyze a range of properties quickly.

Alternative Ways to Request Property Records

While the online system is user-friendly and accessible, some users may prefer to request property records through traditional methods. If you’re unable to find what you need online, the Orange County Property Appraiser’s office provides several alternative ways to obtain documents:

- In-Person Requests: You can visit the Property Appraiser’s office in person. The staff there can help you navigate through the process, assist with specific requests, and provide physical copies of documents.

- Phone Requests: For quick inquiries or to request specific documents, the office may allow you to call and receive guidance on how to obtain records. They can also assist you in verifying data found online.

- Email Requests: For those who prefer written correspondence or need records that may require some processing, email requests are an option. The email address for property record inquiries is typically listed on the official website.

- Mail Requests: In rare cases, individuals might need to send a formal request by mail. This is often the slowest method, but it can be necessary if official, notarized, or certified copies are required.

By providing multiple options for obtaining property records, the Orange County Property Appraiser’s office ensures that all residents, investors, and other users have easy access to the information they need.

Common Property Search Issues & How to Fix Them

Even with a well-designed system, users may sometimes encounter challenges while searching for property records. Understanding common issues and knowing how to resolve them can help streamline your experience.

Address Not Found?

If the address you’re searching for isn’t found, ensure that it’s entered correctly. Double-check spelling, street direction (N, S, E, W), and abbreviations like St, Rd, or Blvd. Use the search tool’s auto-complete suggestions for assistance. Some addresses may be newly added or not yet updated—check back after the next database refresh or search using the parcel number instead.

Owner Name Not Recognized?

Searching by owner name requires an accurate match, typically in “Last, First” format. Try using partial names or known spelling variations. If multiple people own the property, try one name at a time. For best results, avoid extra spaces or punctuation. If the record is still missing, it may be under a business name or trust, so try those alternatives too.

Parcel Number Not Found?

A parcel number is a unique ID tied to a specific lot. If your search comes up empty, verify the number from a trusted source like your property tax statement. Make sure you’re using the correct format. If unsure, try searching by address to retrieve the correct parcel number.

Other Common Property Search Errors

Technical glitches can sometimes affect the tool. If a page doesn’t load or returns a blank result, refresh your browser or try a different device. Ensure your internet connection is stable. For persistent problems, contact the support team listed on the official site. Also, remember that new construction or newly transferred properties might not show up immediately after updates, so a short delay is normal.

Advanced Search Features for Better Results

For users who need to go beyond basic lookups, the Orange County Property Appraiser’s tool offers a suite of advanced search filters. These features are ideal for professionals and users with specific search needs—whether it’s narrowing down by property type, assessing investment trends, or comparing tax values over time. Advanced filters make the property search tool more powerful and customizable, allowing you to refine results with precision and save time.

Advanced options are especially useful when:

- Searching multiple properties for market comparisons

- Analyzing investment opportunities

- Verifying homestead exemption trends

- Locating properties within certain value brackets

You can mix and match filters for customized results. Here’s how each feature works:

Filter by Property Type

This filter allows users to narrow their search based on the property’s classification. Common property types include:

- Single-family residential

- Multi-family homes

- Commercial buildings

- Vacant land

- Industrial and institutional parcels

Choosing a property type helps focus your results on only the assets relevant to your interest. For example, a buyer looking for a commercial property won’t have to sift through residential listings.

Filter by Tax Assessment History

With this option, you can track assessed values and taxes across multiple years. Users can:

- Compare current and past tax amounts

- Evaluate how a property’s value has shifted over time

- Identify trends related to market changes or improvements

This is extremely helpful for long-term investment planning or legal reviews involving back taxes or disputes.

Filter by Market Value & Sale History

This feature enables users to set value ranges for market prices or filter by date of sale. It helps:

- Investors find undervalued or recently sold properties

- Agents spot neighborhoods with rising home values

- Homeowners compare similar homes to determine equity

The tool often includes options to sort by most recent sale date or highest value, depending on what insights are needed.

Additional Advanced Search Filters

Other advanced search options may include:

- Lot size (in square feet or acres)

- Year built or building age

- Zoning code

- Exemption status (homestead, senior, veteran, etc.)

- Sale instrument type (warranty deed, quitclaim deed, etc.)

These granular filters are especially beneficial for professionals such as appraisers, lawyers, developers, and tax consultants who require highly specific data.

All advanced features are available within the same search interface, making it simple to toggle options and adjust your queries. The system instantly updates your results without needing to reload the page, enhancing speed and efficiency.

Related Resources & Helpful Links

Staying informed is easier when you have quick access to the right tools and references. The Orange County Property Appraiser’s office offers a variety of online resources that support homeowners, investors, and professionals in understanding and managing property-related information. Below are key resources designed to complement your property search and provide further assistance as needed:

Key Property Resources

Learn how to save money on property taxes by applying for Florida’s Homestead Exemption. This section includes eligibility requirements, benefits, and a step-by-step guide for applying online or by mail.

Property Tax Estimator

Use the Orange County Tax Estimator tool to calculate your estimated annual property tax based on current millage rates, assessed value, and exemption status. Ideal for planning budgets or evaluating a potential purchase.

GIS Map Viewer

Access detailed, interactive parcel maps through the Geographic Information System (GIS). This tool lets you view zoning layers, flood zones, aerial images, and boundary lines to better understand a property’s surroundings.

Property Value Appeal Instructions

Disagree with your property’s assessed value? Follow the official guide to file an appeal with the Value Adjustment Board. This resource includes important deadlines, required forms, and contact details for assistance.

Official Orange County Property Appraiser Website

Visit the official Orange County Property Appraiser website for the latest updates, Property Appraisal Process, downloadable forms, customer service information, and access to all other tools mentioned above.

FAQ’s

Have questions about how to use the Orange County Property Appraiser’s Property Search tool? You’re not alone. Whether you’re a homeowner, investor, or first-time user, it’s common to need clarification on how to access property records, verify ownership, check tax history, or understand the update schedule. This FAQ section answers the most common inquiries to help you get accurate, reliable results fast. From database updates to ownership verification and fee information, you’ll find all the essential answers in one place—clearly explained for users at any level.

How often is the Orange County property database updated?

The Orange County Property Appraiser’s database is updated regularly to ensure accuracy and reflect the most recent changes. Typically, data such as ownership transfers, market value adjustments, and exemption applications are refreshed daily or weekly, depending on the type of record. This helps users access the most up-to-date property details for research, valuation, or legal purposes.

Can I find historical property records?

Yes, the property search tool allows users to view historical records, including prior owners, past assessed values, and sales history. You can track changes in property ownership and valuation over time, making this a valuable resource for researchers, real estate professionals, and anyone interested in the evolution of a specific parcel. Some archived documents may require a separate records request.

Can I verify property ownership online?

Absolutely. The search tool provides verified information straight from the official property database. You can see the current owner’s full name, date of last transfer, and details from the recorded deed. This is particularly helpful for confirming legal ownership before a sale, resolving disputes, or researching a property’s background.

What if property details are incorrect?

If you notice errors in your property details—such as the owner name, square footage, or exemption status—you can contact the Orange County Property Appraiser’s office to request a correction. Most updates require proof, like a recorded deed or permit. There’s usually a form available online or you can submit an inquiry through their contact page.

How can I check past tax payments on a property?

To check previous property tax payments, visit the Orange County Tax Collector’s website. While the Property Appraiser determines value and exemptions, the Tax Collector handles billing and payment history. You can search by parcel number or address and view yearly tax bills, payment status, and late fee details.